Principal Residence Exclusion Information, and

Municipal Property Tax Links for Hampden County Home Owners

For most people, the opportunity to exclude the gain on the sale of their home is the biggest tax exclusion of their lifetime. But this income tax exclusion can be lost if you transfer your home to someone else! Careful planning includes advising you and your family about unexpected mistakes and problems involving taxation and the transfer of your home. Risks you must consider BEFORE transferring ownership of your home.

§121 of the Internal Revenue Code is the authority for the principal residence exclusion. This law excludes:

- $250,000 in gain on the sale of a principal residence for a single homeowner, or

- $500,000 of gain for home owned by a married couple.

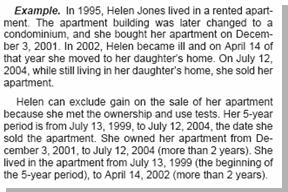

To exclude this gain you must pass two tests:

- Ownership test: During the 5 year period ending on the date of the sale you owned the home for at least 2 years;

- Residence Use Test: During that 5 year period, you lived in the home as your main home, and during the 2 year period ending on the date of the sale, you didn't exclude gain from sale of another home.

You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale of your house. The IRS regulations at 26 CFR Section 1.121-1(c) and IRS Publication 523 have more examples of how an elder can satisfy the ownership and use tests:

The Use Test is less strict for elders who need care that can’t be provided in their residence. Special Rules in §121(d)(7) give a safe harbor to people who become incapable of self-care. If they own the property used as the principal residence during the 5-year period for periods aggregating at least 1 year, they are treated as using such property as their principal residence during any time during such 5-year period in which the taxpayer owns the property and resides in a licensed facility, such as a nursing home.

You can also take advantage of the Principal Residence Exclusion If your house is owned by a grantor trust, such as a Living Trust or an Irrevocable Trust. Sections 671 through 679 of the Internal Revenue Code, relating to the treatment of grantors and others as substantial owners, make it possible for you to be treated as the homeowner, since you are the owner of the trust or the portion of the trust that includes the residence.

There are Safe Harbors, providing partial exclusion of gain, such as change in place of employment, health, or unforeseen circumstances. Pub 523 has worksheets and explanations. Call to schedule an Educational Meeting if you would like to review your special circumstances, and get advice on all the options for protecting your rights to the principal residence exclusion.